Peak conventional crude petroleum oil production is apparently here already – the only thing that’s been growing global total liquids is North American unconventional oils : tight oil – which includes shale oil in the United States of America – and tar sands oil from bitumen in Canada – either refined into synthetic crude, or blended with other oils – both heavy and light.

But there’s a problem with unconventional oils – or rather several – but the key one is the commodity price of oil, which has been low for many months, and has caused unconventional oil producers to rein in their operations. It’s hitting conventional producers too. A quick check of Section 3 “Oil data : upstream” in OPEC’s 2016 Annual Statistical Bulletin shows a worrying number of negative 2014 to 2015 change values – for example “Active rigs by country”, “Wells completed in OPEC Members”, and “Producing wells in OPEC Members”.

But in the short term, it’s the loss of uneconomic unconventional oil production that will hit hardest. Besides problems with operational margins for all forms of unconventionals, exceptional air temperatures (should we mention global warming yet ?) in the northern part of North America have contributed to a seizure in Canadian tar sands oil production – because of extensive wildfires.

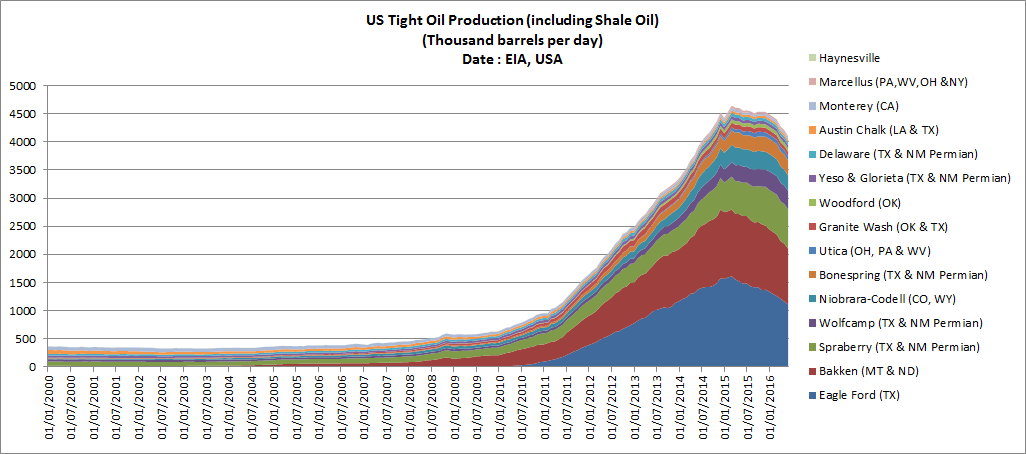

Here’s two charted summaries of the most recent data from the EIA on tight oil (which includes shale oil) and dry shale gas production in the United States – which is also suffering.

Once the drop in North American unconventionals begins to register in statistics for global total liquids production, some concern will probably be expressed. Peak Oil just might be sharper and harder and sooner than some people think.